In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-LTC form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 4 copies of Forms 1099-LTC. Here is a break down of where all these forms end up:

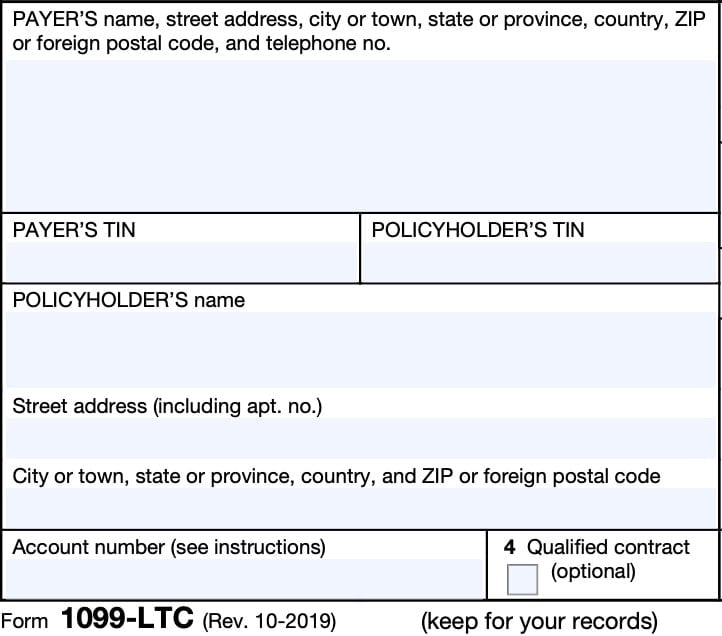

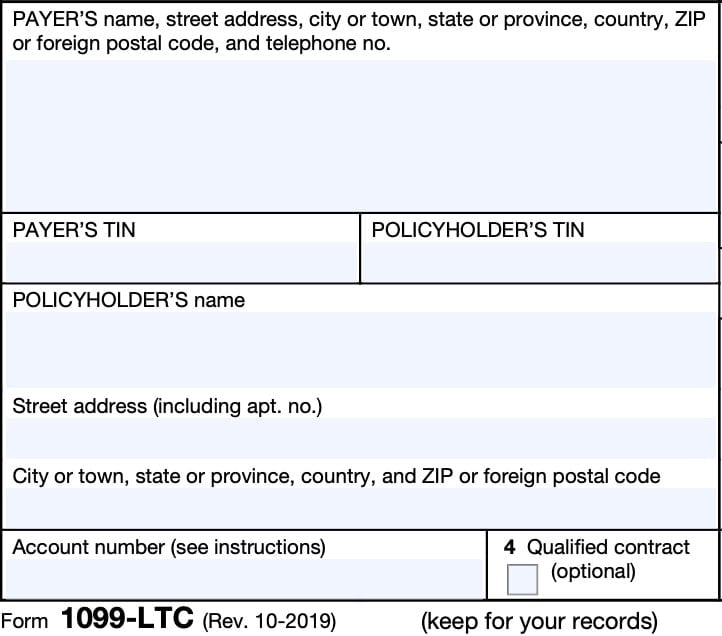

Let’s get into the form itself, starting with the information fields on the left side of the form.

You should see the payer’s contact information, with complete business name, address, zip code, and telephone number in this field.

This is the payer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The payer’s TIN should never be truncated.

As the policyholder and recipient of IRS Form 1099-LTC, you should see your taxpayer identification number in this field. The TIN can be any of the following:

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your payer have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

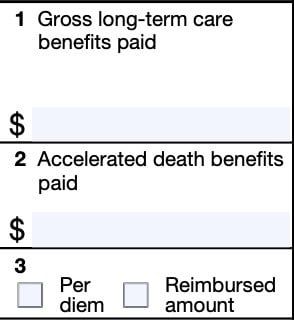

On the right-hand side of Form 1099-LTC, you’ll see the relevant tax information.

Generally, proceeds from a long term care policy are tax free. However, individual circumstances vary, and the information on the right side of the form will help individual taxpayers understand the tax implications of their LTC benefit.

Let’s start with Box 1.

Box 1 shows the gross benefits paid under a long-term care insurance contract during the year.

Your payer must enter the gross long-term care benefits paid out during the current tax year. However, this does not include accelerated death benefits, which are reported in Box 2.

These benefits are all amounts that were paid out in one of the following manners:

Box 1 includes the following payment amounts:

Your payer is not required to determine whether or not any LTC benefits are taxable or nontaxable. This is the responsibility of individual taxpayers.

IRS Form 1099-LTC does not contain enough information to determine whether your LTC insurance proceeds are includible as taxable income.

To make this determination, you’ll need to complete and file IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts. Taxpayers may use IRS Form 8853 to determine the taxability of any of the following:

Box 2 shows the gross accelerated death benefits paid during the year.

Your payer must enter the gross accelerated death benefits paid under a life insurance contract. This includes accelerated benefits paid to an insured who has been certified as terminally or chronically ill, or on the insured person’s behalf.

The Internal Revenue Service defines a terminally ill individual as someone who has been certified by a physician as having an illness or physical condition that can reasonably be expected to result in death in 24 months or less after the date of certification.

Amounts paid as accelerated death benefits are fully excludable from gross income if the insured has been certified by a physician as terminally ill.

The IRS defines a chronically ill individual as someone who has been certified (at least on an annual basis) by a licensed health care practitioner as one of the following:

Accelerated death benefits paid on behalf of individuals who are certified as chronically ill are excludable from income to the same extent they would be if paid under a qualified long-term care insurance contract.

Box 2 also includes amounts paid by a viatical settlement provider for the sale or assignment of the insured’s death benefit under a life insurance contract.

A viatical settlement provider is any person who:

For terminally ill individuals, the provider must meet the requirements of Sections 8 and 9 of the Viatical Settlements Model Act of the National Association of Insurance Commissioners (NAIC), relating to disclosure and general rules.

The provider must also meet the requirements of the Model Regulations of the NAIC for evaluating the reasonableness of amounts paid in viatical settlement transactions with terminally ill individuals.

If the insured is chronically ill, the provider must meet requirements similar to those of sections 8 and 9 of the Viatical Settlements Model Act of the NAIC and must also meet any standards of the NAIC for evaluating the reasonableness of amounts paid in viatical settlement transactions with chronically ill individuals.

Box 3 indicates whether or not the amount of benefits paid in Box 1 or Box 2 were paid on a per diem basis, or as reimbursement for actual long-term care expenses.

As mentioned in Box 1 above, per diem refers to payments made on a periodic basis without regard to actual long-term care expenses incurred. This usually is on a daily basis.

Conversely, reimbursed basis refers to benefit amounts paid to reimburse the policy holder for actual expenses incurred for long-term care services.

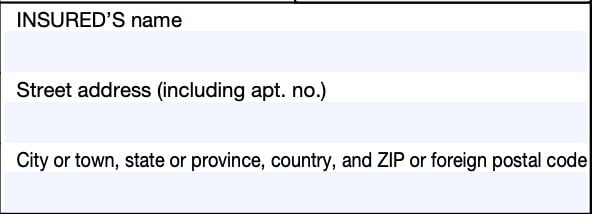

To the right of Box 3, and just below are information fields for the insured individual. Let’s take a closer look.

This field should contain the insured’s Social Security number or other federal tax identification number.

This field should contain the insured individual’s name and street address, if different from the policyholder.

This optional field may show if the benefits were from a qualified long-term care insurance

contract.

A contract issued after 1996 is a qualified long-term care insurance contract if it meets the requirements of Internal Revenue Code Section 7702B, regarding tax treatment of qualified long-term care insurance contracts.

This includes the requirement that the insured must be a chronically ill individual, as previously defined.

A long-term care insurance policy contract issued before 1997 generally is treated as a tax-qualified long-term care insurance contract if it:

However, this field is optional, and may not contain any information.

Box 5 may contain a check depending on the insured’s status.

If the covered individual meets the requirements for a chronically ill person, the Chronically ill box should be checked. If the person meets the requirements for a terminally ill individual, then the Terminally ill box should be checked.

Next to these boxes, the Date certified field should indicate the most recent date that the status was certified by a licensed healthcare practitioner or physician.

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Learn more about IRS Form 1099-LTC by watching this informational video.

It depends. Generally, the amount of money received from a tax-qualified policy is not considered taxable income, while part of the benefits from a non-tax qualified policy may be taxable. You may need to complete IRS Form 8853 to determine taxability of LTC proceeds.

When should I receive IRS Form 1099-LTC?Generally, taxpayers should expect to receive recipient copies of their 1099-LTC forms no later than January 31 for proceeds issued in the prior tax year. If you have not received your Form 1099-LTC by February 15, you should contact your policy holder or the IRS for assistance.

How can LTC benefits be received tax-free by an individual?In general, benefit payments that you receive under a qualified long-term care insurance policy are tax free. Qualified policies must be guaranteed renewable, and they can’t have any cash value.

As with most free tax forms, you can find IRS Form 1099-LTC on the IRS website. For your convenience, we’ve enclosed the most recent version of IRS Form 1099-LTC in this article, just below.